Empowering Entrepreneurs: Leveraging Difficult Cash Car Loans for Service Growth

In the realm of entrepreneurship, the quest of growth and growth usually rests on securing adequate financial resources. Hard money finances have actually arised as a feasible alternative for entrepreneurs seeking to utilize exterior funding to thrust their services onward. While the concept of hard money fundings might seem straightforward, the details of this financial tool hold the prospective to encourage entrepreneurs in means that conventional lending may not. By discovering the nuances of tough cash financings and their implications for company development, business owners can acquire useful insights right into how this alternate funding technique might be the catalyst for their following stage of growth.

Understanding Hard Cash Fundings

Difficult cash car loans are a form of financing typically safeguarded by the value of a residential or commercial property, supplying a quicker and much more flexible option for debtors with certain financing needs. hard money loans in ga. Unlike standard financial institution car loans, difficult money fundings are commonly supplied by exclusive capitalists or companies and are based on the security worth of the residential or commercial property as opposed to the consumer's creditworthiness. This makes difficult cash financings perfect for people or companies that may not certify for standard car loans as a result of credit problems, income verification issues, or the need for a quick funding process

The application process for tough money loans is commonly quicker and much less rigorous than typical lendings, making them an appealing choice for debtors aiming to safeguard funding quickly. While typical financings might take weeks and even months to approve, hard cash fundings can commonly be processed in a matter of days. In addition, difficult money lenders are extra happy to deal with borrowers on a case-by-case basis, permitting more tailored and versatile terms to meet the borrower's details requirements.

Benefits for Business Development

Leveraging hard cash financings can use considerable advantages for entrepreneurs looking for fast company expansion through different funding services. One vital benefit is the speed at which hard cash finances can be protected compared to traditional financial institution financings. This fast access to resources permits entrepreneurs to profit from time-sensitive opportunities, such as acquiring inventory at a reduced rate or investing in new equipment to enhance manufacturing ability.

Additionally, tough money finances are asset-based, meaning that the financing authorization is primarily based on the value of the collateral rather than the customer's credit report. This aspect makes hard money lendings much more easily accessible to business owners with less-than-perfect credit history backgrounds, allowing them to get the essential financing to expand their businesses.

Furthermore, hard money loan providers usually have more flexible underwriting criteria than standard financial institutions, permitting business owners to customize finance terms that match their particular requirements. This flexibility can be especially advantageous for entrepreneurs seeking to finance one-of-a-kind projects or ventures that might not fit within the inflexible standards of conventional loan provider. Eventually, leveraging hard cash lendings can be a calculated tool for entrepreneurial see here growth, offering access to capital quickly, despite credit report, and with more adaptability in loan terms.

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

Qualification and Application Refine

When considering tough cash fundings for service growth, understanding the eligibility requirements and application procedure is vital for business owners looking for alternative funding alternatives. Lenders using tough cash financings are largely concerned with the residential or commercial property's potential to produce returns and the customer's ability to pay back the financing. The application process for difficult money fundings is usually quicker than traditional bank finances, with choices being made based on the home's worth and potential success of the service expansion.

Leveraging Difficult Cash for Development

Understanding the tactical usage of alternate funding mechanisms Homepage like hard cash lendings can considerably bolster service development initiatives for business owners. By accessing hard money lendings, entrepreneurs can safeguard funding rapidly without the substantial documents and approval processes normally associated with conventional fundings.

In addition, hard money fundings supply adaptability in terms of collateral demands, making them easily accessible to business owners that may not have substantial possessions or a strong credit rating. This facet is particularly helpful for organizations wanting to broaden rapidly or those operating in markets with ever-changing capital. Furthermore, the temporary nature of hard cash car loans can be beneficial for entrepreneurs seeking to money specific growth tasks without dedicating to lasting financial obligation commitments. On the whole, leveraging tough cash for growth offers business owners with a flexible funding device to support their development ambitions effectively and successfully.

Threats and Factors To Consider

Cautious assessment of potential risks and considerations is extremely important when checking out the utilization of hard cash car loans for company growth. Among the key risks related to tough money car loans is the high-interest prices they carry. Unlike typical small business loan, tough cash loans generally include considerably greater rate of interest prices, which can enhance the total cost of loaning and impact the productivity of business. In addition, hard cash car loans often need much shorter repayment periods, increasing the monetary stress on the borrower to satisfy the settlement terms quickly.

Considering that hard cash lending institutions focus extra on the collateral's worth instead than the customer's credit reliability, there is a higher danger of shedding important properties if the business stops working to settle the financing as agreed. Business owners must very carefully consider these risks and factors to consider prior to opting for difficult cash car loans to make certain that they align with their service objectives and monetary capacities.

Final Thought

Ralph Macchio Then & Now!

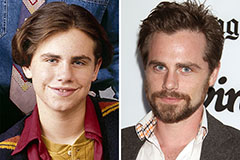

Ralph Macchio Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!